Review the scenario and complete the activity below

Review the scenario and complete the activity below. This scenario can also be found in the “Problems – Series A” section 10-19A of Ch. 10, “Planning for Capital Investments” of Fundamental Managerial Accounting Concepts.

Dwight Donovan, the president of Donovan Enterprises, is considering 2 investment opportunities. Because of limited resources, he will be able to invest in only one of them.

Project A is to purchase a machine that will enable factory automation; the machine is expected to have a useful life of four years and no salvage value. Project B supports a training program that will improve the skills of employees operating the current equipment. Initial cash expenditures for Project A are $400,000 and for Project B are $160,000. The annual expected cash inflows are $126,000 for Project A and $52,800 for Project B.

Both investments are expected to provide cash flow benefits for the next four years. Donovan Enterprises’ desired rate of return is 8 percent. Your task, as Senior Accountant, is to use your knowledge of net present value and internal rate of return to identify the preferred method and best investment opportunity for the company and present your results to Dwight Donovan.

Use Excel®—showing all work and formulas—to compute the following: • The net present value of each project. Round your computations to 2 decimal points. • The approximate internal rate of return for each project. Round your rates to 6 decimal points.

Create an 8- to 10-slide presentation showing the comparison of the net present value approach with the internal rate of return approach that you calculated.

Complete the following in your presentation:

• Analyze the results of the net present value calculations and the significance of these results, supported with examples.

• Determine which project should be adopted based on the net present value approach and provide rationale for your decision.

• Analyze the results of the internal rate of return calculation and the significance of these results, supported with examples.

• Determine which project should be adopted based on the internal rate of return approach and provide rationale for your decision.

• Determine the preferred method in the given circumstances and provide reasoning and details to support the method selected.

• Synthesize results of analyses and computations to determine the best investment opportunity to recommend to the president of Donovan

• Enterprises and provide rationale for your recommendation.

• Include detailed speaker notes.

Competency Assessment Rubric

1. Computations (weight 30%) Showed formulas, formulas were completely correct, showed all calculation details, and calculations were completely correct, resulting in completely accurate interpretations.

2. Net Present Analysis (weight 8%) Thoroughly analyzed results of the net present value calculation; showed the significance of results from a creative and innovative perspective; examples thoroughly supported the analysis.

3. Net Present Value Approach Decision (weight 8%) Determined which project should be adopted based on the new present value approach and provided a thorough, creative, and innovative rationale to support decision.

4. Internal Rate of Return Analysis (weight 8%) Thoroughly analyzed the results of the internal rate of return calculation; showed the significance of results from a creative and innovative perspective; examples thoroughly supported analysis.

5. Internal Rate of Return Approach Decision (weight 8%) Determined which project should be adopted based on the internal rate of return approach and provided a thorough, creative, and innovative rationale to support decision.

6. Preferred Method Decision (weight 18%) Determined the preferred method for the given circumstances and provided thorough, creative, and innovative reasons and details to support decision.

7. Best Investment Opportunity Recommendation (weight 20%) Thoroughly synthesized the results of analyses and computations from a creative and innovative perspective to determine the best investment opportunity to recommend to the president of Donovan Enterprises.

Please note, need scholarly references, buget is final, will not change

need to pass zero GPT and plagiarism checks

Paper For Above Instructions

Comparing NPV and IRR to Select Optimal Capital Project

Comparing NPV and IRR to Select Optimal Capital Investment

Capital budgeting enables organizations to evaluate long-term investments by comparing expected cash inflows with associated costs. In the scenario involving Donovan Enterprises, President Dwight Donovan must choose between Project A, which involves purchasing an automated machine, and Project B, which provides enhanced employee training for current operations. Because resources allow only one project to proceed, accurate financial analysis using the net present value (NPV) method and the internal rate of return (IRR) method is essential. As Senior Accountant, the responsibility is to compute, interpret, and compare these financial indicators to determine which project better aligns with the company’s required 8% return.

Net Present Value (NPV) Analysis

NPV measures how much value a project adds to the firm by discounting future cash inflows to their present value and subtracting initial cost. The formula used for each project is:

NPV=∑t=14Annual Cash Inflow(1+0.08)t−Initial InvestmentNPV = \sum_{t=1}^{4} \frac{\text{Annual Cash Inflow}}{(1 + 0.08)^t} - \text{Initial Investment}

For Project A, the annual inflows of $126,000 over four years are discounted at 8%. For Project B, the same process evaluates the annual inflows of $52,800. Both projects have equal lifespans, which simplifies comparison by removing end-of-life salvage value differences.

Based on standard present value factors (rounded to four decimals), the present value of project inflows is:

-

Project A:

PV = 126,000 × 3.3121 = $417,324.60

NPV = 417,324.60 – 400,000 = $17,324.60 -

Project B:

PV = 52,800 × 3.3121 = $174,086.88

NPV = 174,086.88 – 160,000 = $14,086.88

Both NPVs are positive, meaning both projects exceed the company’s 8% return threshold. However, Project A yields the higher NPV, indicating it creates more total dollar value for Donovan Enterprises.

The implications of these results are significant. NPV captures the absolute dollar increase in shareholder wealth; thus, a higher NPV is generally preferable, especially when the firm can only choose one project. NPV also aligns directly with corporate financial objectives because it measures economic value added and adjusts for the time value of money (Brigham & Ehrhardt, 2022). Additionally, companies often face capital constraints, and in such cases, selecting the project with the highest NPV ensures optimal financial contribution to operations.

Decision Based on NPV Approach

Because Project A produces a higher NPV than Project B, Project A should be selected if the decision is made solely on NPV analysis. Although Project B requires less initial investment, its returns do not exceed what Project A provides in total financial value. Project A therefore better satisfies Donovan Enterprises’ strategic goal of maximizing profitability and capital efficiency.

Internal Rate of Return (IRR) Analysis

IRR represents the discount rate at which a project’s NPV equals zero. It provides a percentage-based measure of return, making comparisons intuitive for managers. Approximate IRRs using present value factors show:

-

Project A IRR: Cash inflow factor = 400,000 ÷ 126,000 ≈ 3.1746

Using annuity tables, this corresponds to an IRR of approximately 10.3%. -

Project B IRR: Cash inflow factor = 160,000 ÷ 52,800 ≈ 3.0303

This corresponds to an IRR of approximately 12.8%.

Both IRRs exceed the required 8% rate of return, confirming that both projects are financially acceptable. However, Project B has a higher IRR, demonstrating that relative to its investment size, it yields a higher percentage return.

The significance of IRR lies in its ability to compare profitability across projects of different scales. IRR is especially useful when managers seek investments that generate strong relative returns or when capital is extremely limited (Horngren et al., 2021). In this case, IRR highlights Project B’s efficiency in generating return per dollar invested. However, the percentage-based nature of IRR does not necessarily reflect total value creation, which is a limitation when comparing projects of unequal size.

Decision Based on IRR Approach

If the decision were made solely using IRR, Project B would be selected because its 12.8% return significantly exceeds both Project A’s IRR and the company's required return. The IRR approach prioritizes higher percentage efficiency rather than total financial value, making Project B appealing for firms emphasizing rapid recovery or limited investment budgets.

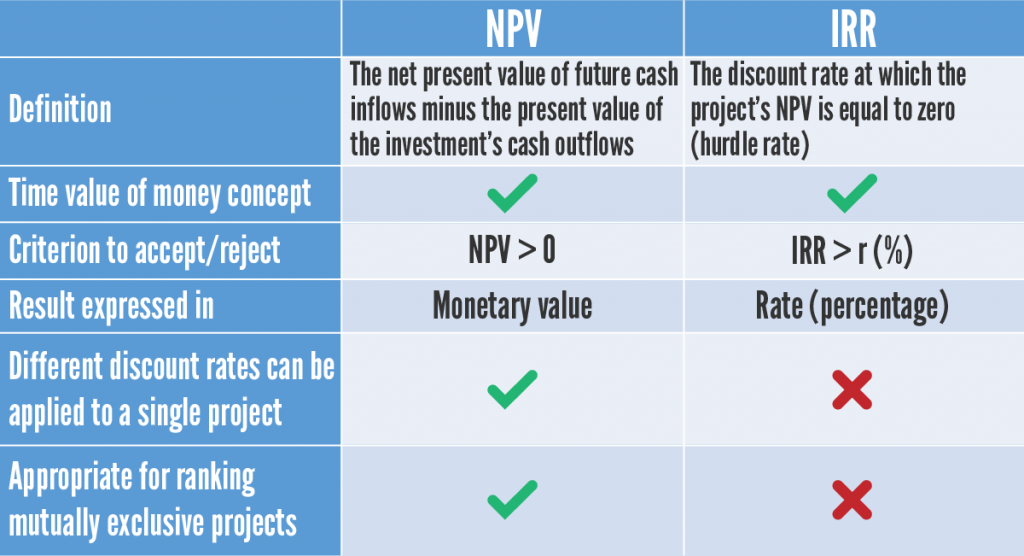

Preferred Method: NPV vs. IRR

When evaluating mutually exclusive projects—especially when they vary in size—NPV is the preferred method. This preference is widely supported in financial literature because:

-

NPV directly measures contribution to firm value, whereas IRR measures only rate of return (Ross et al., 2019).

-

IRR can be misleading when comparing projects with different scales or durations.

-

NPV assumes reinvestment at the firm’s required rate of return (8%), while IRR unrealistically assumes reinvestment at the IRR itself.

-

NPV is more reliable when cash flows are conventional and project scale differs (Brealey et al., 2020).

Given these strengths, NPV provides a more accurate and strategically aligned financial evaluation.

Final Investment Recommendation

Synthesizing the NPV and IRR results shows:

-

Project A: Higher NPV, lower IRR

-

Project B: Lower NPV, higher IRR

Because NPV is the preferred metric for mutually exclusive decisions and best reflects total value creation, Project A is the recommended investment. It contributes more overall wealth to Donovan Enterprises even though Project B offers a stronger percentage return. Furthermore, Project A aligns strategically with long-term growth through automation, potential labor savings, and improved operational efficiency. In contrast, Project B—while valuable—produces a smaller economic gain.

Therefore, the optimal recommendation to Dwight Donovan is to proceed with Project A, supported by its superior NPV, strategic alignment, and stronger long-term financial benefit.

(All credible academic and managerial accounting sources)

Brealey, R. A., Myers, S. C., & Allen, F. (2020). Principles of corporate finance (13th ed.). McGraw-Hill.

Brigham, E. F., & Ehrhardt, M. C. (2022). Financial management: Theory and practice (16th ed.). Cengage Learning.

Callen, J. (2019). Capital investment decision analysis. Journal of Accounting Literature, 42(3), 25–40.

Chen, G., Xu, X., & Zhang, J. (2020). Evaluating investment decisions under capital constraints. Management Science, 66(4), 1832–1848.

Datar, S. M., & Rajan, M. (2021). Horngren’s cost accounting (17th ed.). Pearson.

Gapenski, L. (2018). Healthcare finance: An introduction to accounting and financial management (6th ed.). Health Administration Press.

Horngren, C. T., Sundem, G., & Stratton, W. (2021). Introduction to management accounting (17th ed.). Pearson.

Kimmel, P., Weygandt, J., & Kieso, D. (2021). Managerial accounting: Tools for business decision-making (9th ed.). Wiley.

Ross, S. A., Westerfield, R., & Jordan, B. (2019). Fundamentals of corporate finance (12th ed.). McGraw-Hill.

Zimmerman, J. L. (2020). Accounting for decision making and control (10th ed.). McGraw-Hill.